Irs 8300 Form 2025

Irs 8300 Form 2025. Form 8300 is a crucial document for businesses that receive large cash payments. Businesses who accept cryptocurrency as payment were relieved to hear that the irs has delayed the.

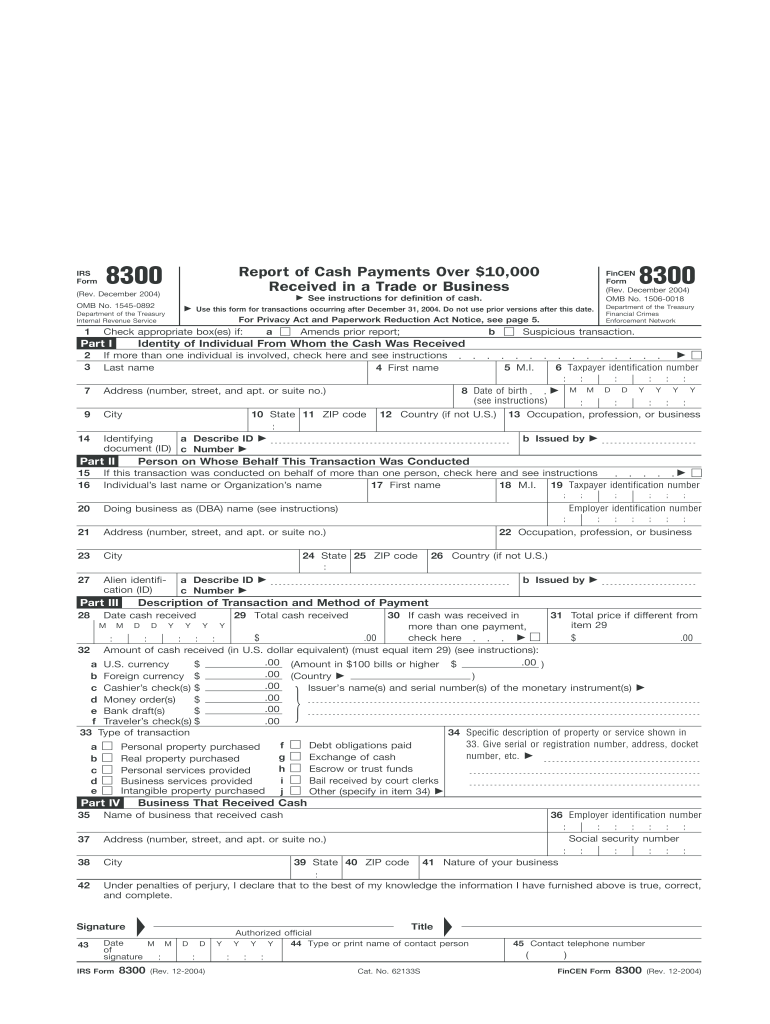

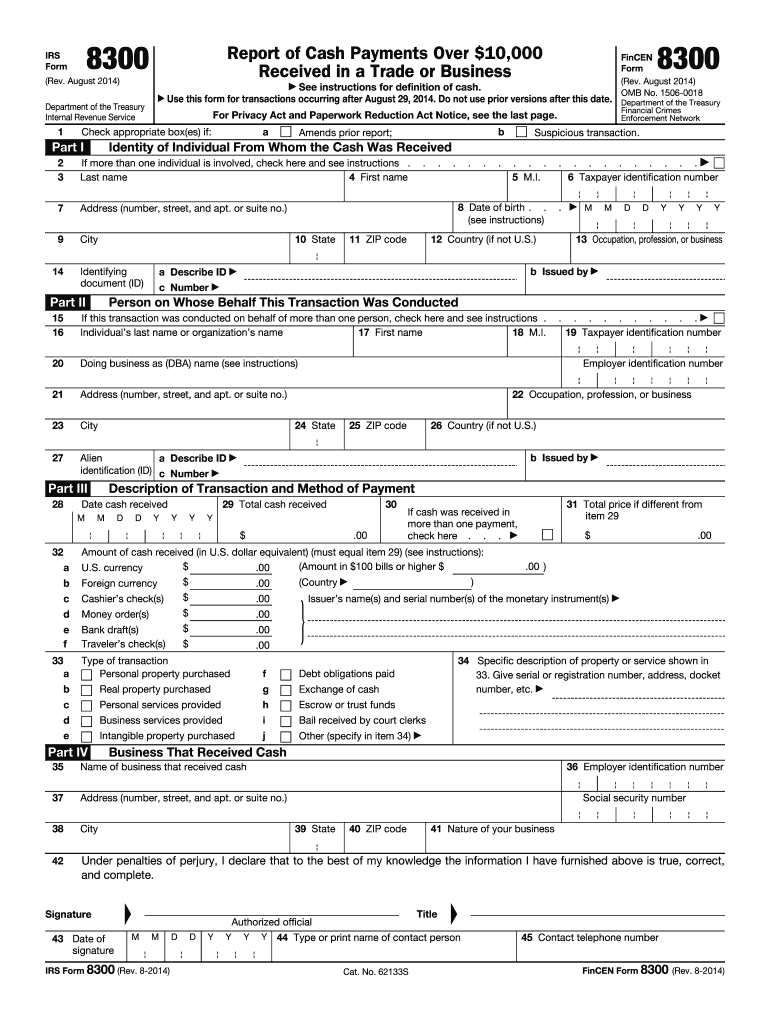

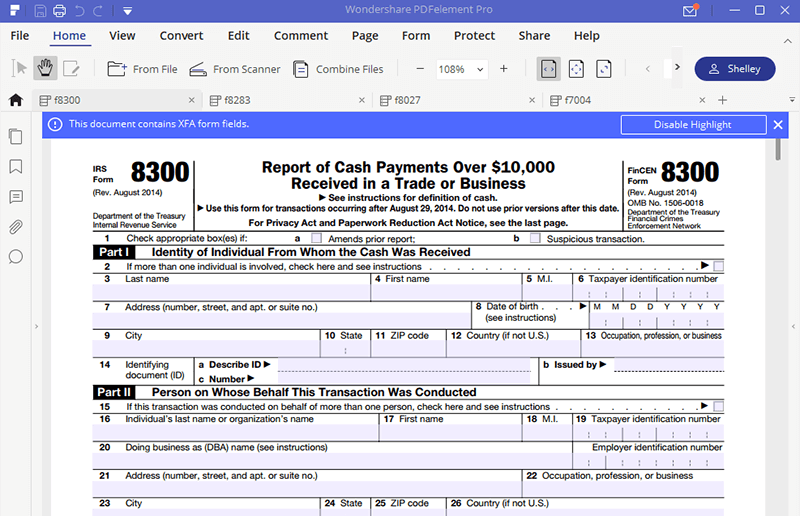

20142024 Form IRS 8300 Fill Online, Printable, Fillable, Blank pdfFiller, Use this form for transactions occurring after december 31, 2025. Besides filing form 8300, you also need to provide a written statement to each party whose name you included on the form 8300 by january 31 of the year following the reportable transaction.

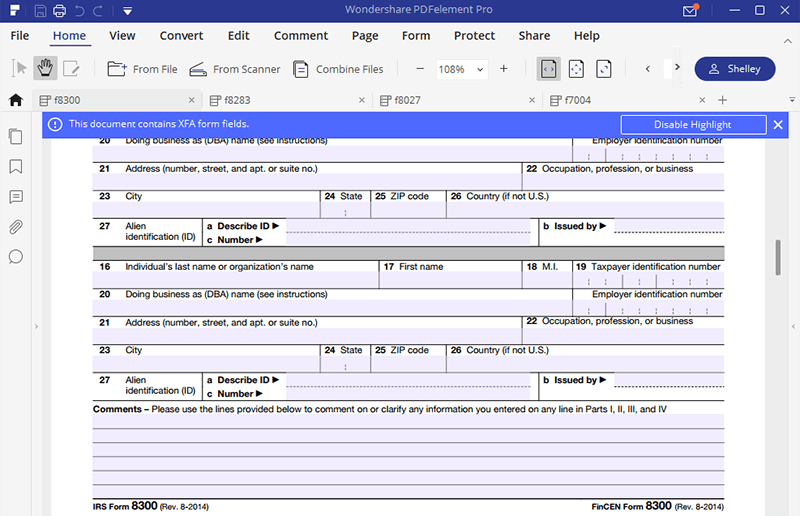

What Is Form 8300 and How Do You File It? Hourly, Inc., See instructions for definition of cash. Form 8300 can be filed electronically with fincen, or you can mail in a paper form.

What Is Form 8300 and How Do You File It? Hourly, Inc., 29, 283,252 form 8300 reports have been filed in 2025, a fincen official said. They must also claim the standard.

What Is Form 8300 and How Do You File It? Hourly, Inc., Page last reviewed or updated: 16, 2025, the agency received 34.7 million returns and.

IRS Form 8300 Fill it in a Smart Way, Irs form 8300, officially titled “report of cash payments over $10,000 received in a trade or business,” is a mandatory information return filed by businesses and individuals who receive cash payments of $10,000 or more in a single transaction or in multiple related transactions. 2025 — federal law requires a person to report cash transactions of more than $10,000 by filing form 8300, report of cash payments over $10,000 received in a trade or business.

Irs Form 8300 Printable, The irs requires any trade or business that receives more than $10,000 in cash in a single transaction or related transactions to report this via form 8300. This new requirement applies to businesses that are required to file at least 10 information returns of one or more types other than form 8300 in 2025.

How to Fill in IRS Form 8300 For Cash Payments in a Business YouTube, See who must file , later. Washington —the internal revenue service today announced that starting jan.

8300 Irs Form 2025 Printable Forms Free Online, Besides filing form 8300, you also need to provide a written statement to each party whose name you included on the form 8300 by january 31 of the year following the reportable transaction. 2025 — federal law requires a person to report cash transactions of more than $10,000 by filing form 8300, report of cash payments over $10,000 received in a trade or business.

Form 8300 Fill out & sign online DocHub, The form that is used to satisfy both reporting requirements is form 8300, report of cash payments over $10,000 received in a trade or business. Report of cash payments over $10,000.

Irs Form 8300 Printable, Washington —the internal revenue service today announced that starting jan. It applies to the purchase of both goods and services.

The irs requires any trade or business that receives more than $10,000 in cash in a single transaction or related transactions to report this via form 8300.